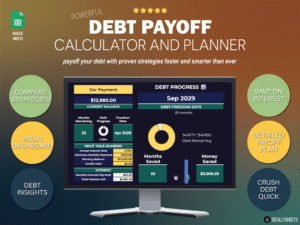

Built to pay off credit card and loan debt fast — save on interest payments and stay organized.

Strategize the best plan to pay off your debt faster and smarter than ever before. This powerful Google Sheets debt planner includes built-in debt payoff calculators using the popular snowball, avalanche, and custom strategies. Visualize your debt payoff with dynamic charts, track monthly payments, and see your progress and debt freedom date. View important metrics like total interest paid and payoff duration for each debt so you can understand the actual cost of your debt and create a plan that works. Whether it’s credit cards or loans, this tool is built to help you save money and time!

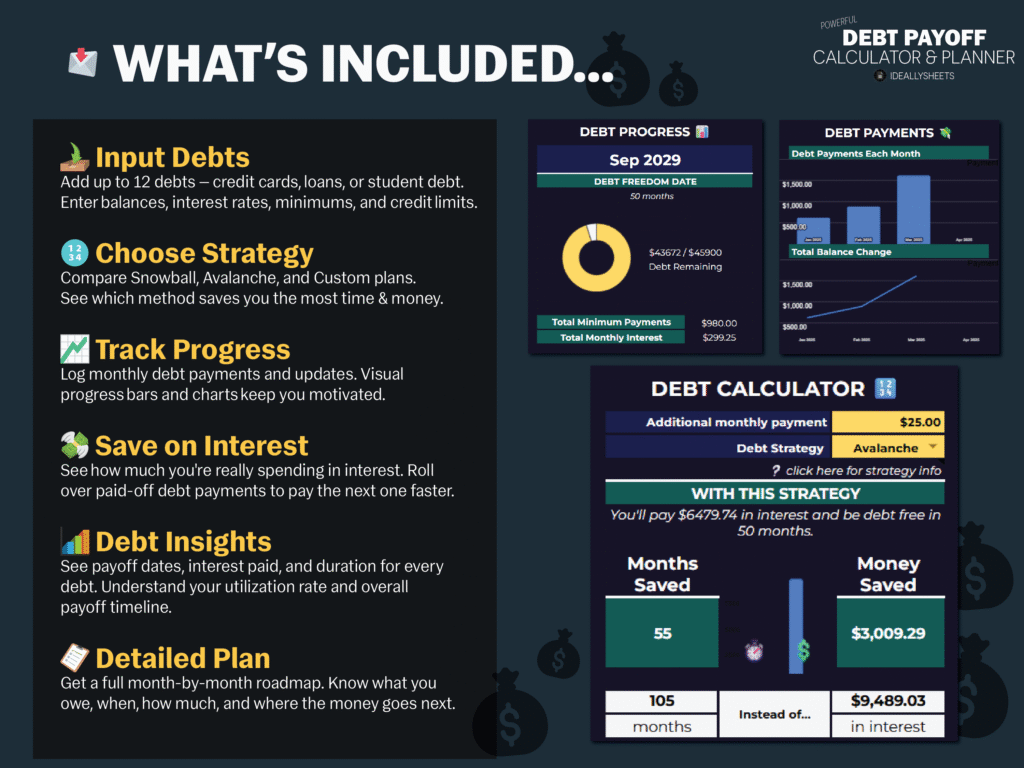

What’s Included in Your Debt Payoff Planner

- Input up to 12 debts — credit cards, loans, student debt, and more

- Choose and compare payoff strategies tailored to save time & money— Snowball, Avalanche, or Custom

- Automatically calculate key metrics — debt duration, total interest, monthly interest, and more

- Track your progress over time — including a full debt payoff date and balance trends

- Full visual dashboard — includes progress bars, payoff strategy comparison, and pie charts

- Understand your debt allocation — view utilization rates and how each debt impacts your total

- Detailed plan for each debt — when it will be paid off, how much interest you’ll pay, and what’s next

- Log your debt- update your balance as you pay off your debt

- Stay organized and motivated — all your debts, progress, and payoff data in one smart, powerful tool

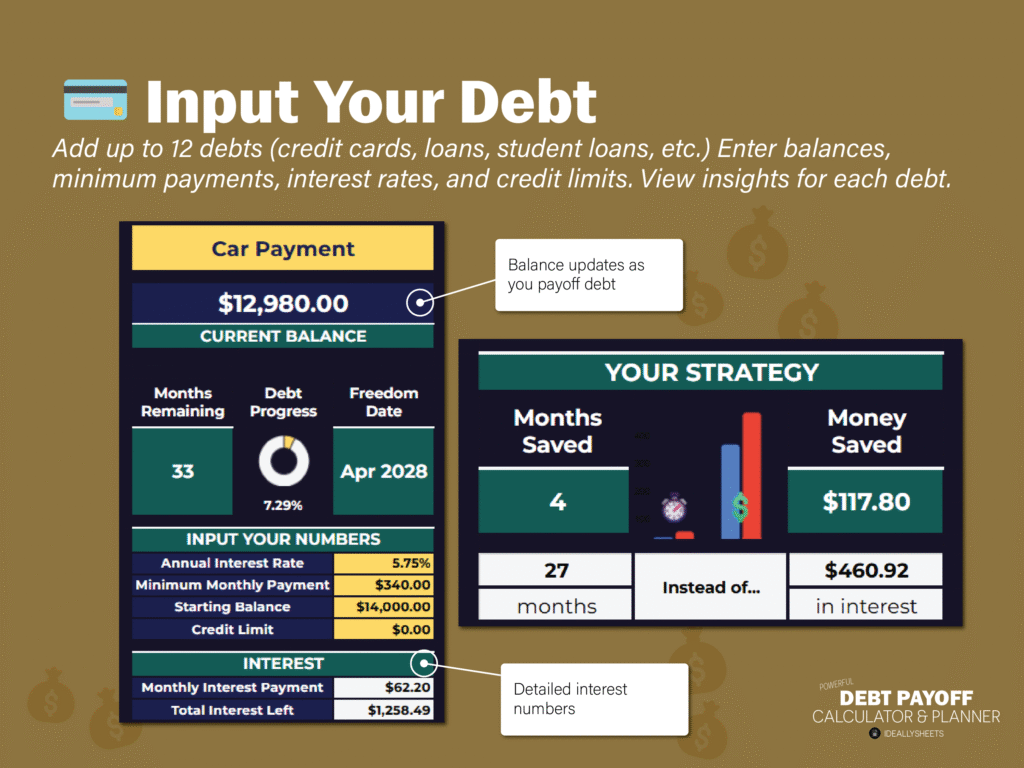

Input Your Debt into the Planner

Everything starts here — simple and powerful.

- Add up to 12 debts (credit cards, loans, student loans, etc.)

- Enter balances, minimum payments, interest rates, and credit limits

- View insightful metrics for each debt

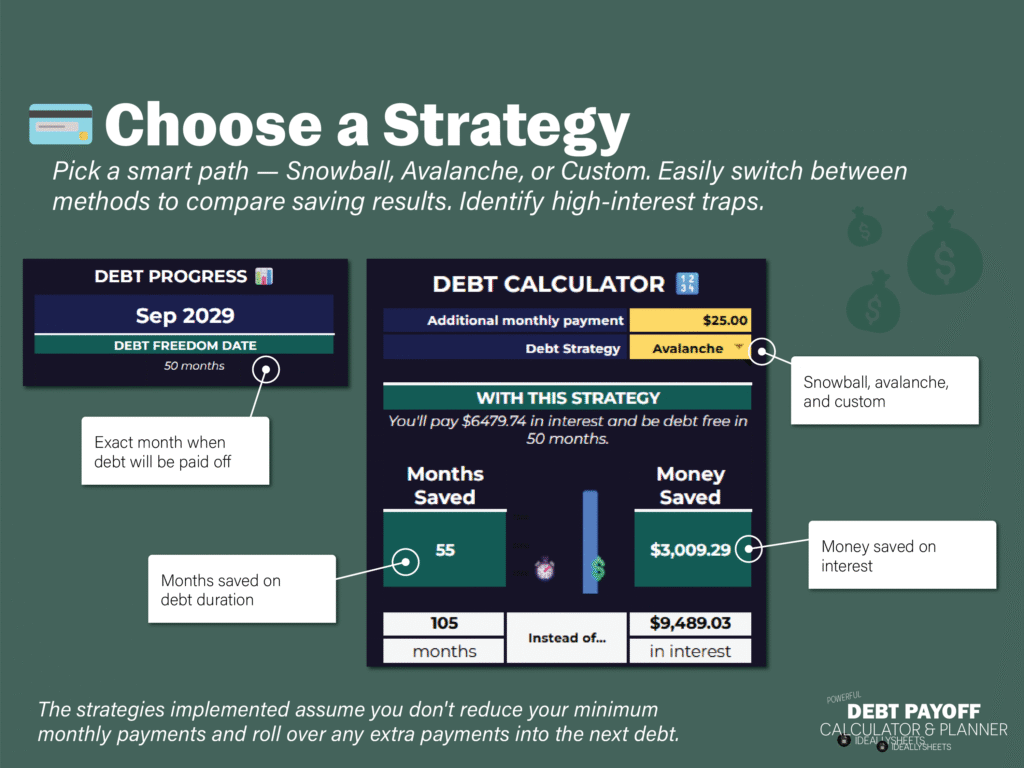

Choose a Strategy for Debt Payoff with the Debt Calculator

Pick a smart path — Snowball, Avalanche, or Custom.

- Easily switch between methods to compare saving results

- Use the built-in debt calculator to simulate savings

- Choose the plan that pays off debt fastest or saves the most

- Identify high-interest traps

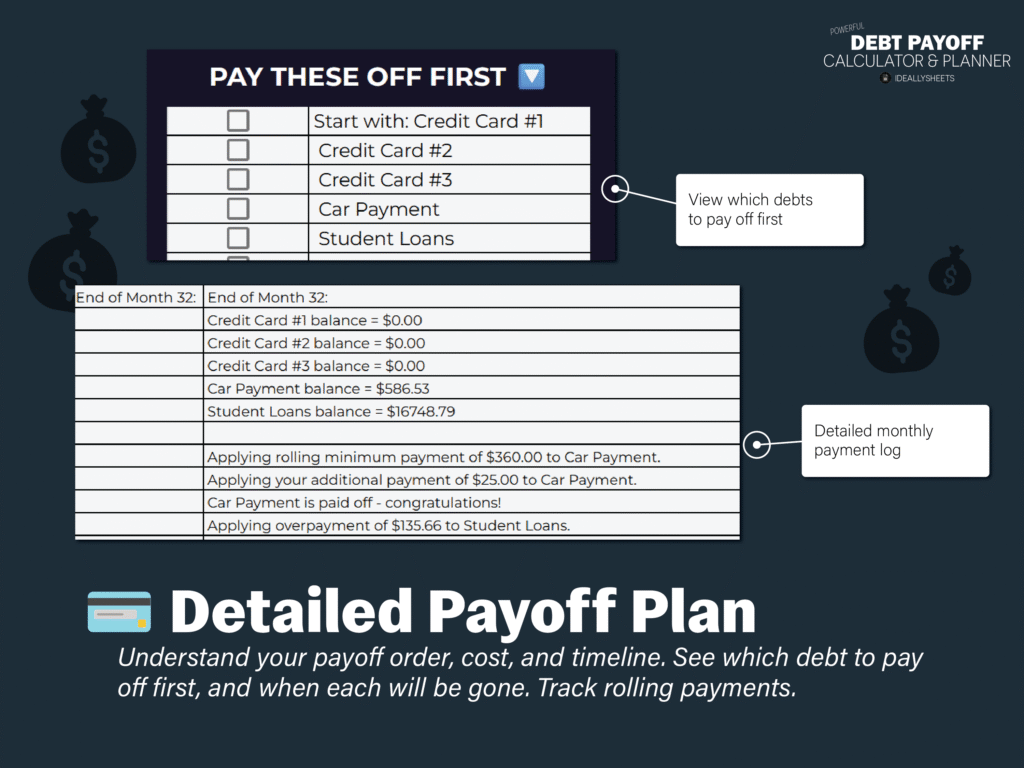

Get a Detailed Payoff Plan to Save Time & Money

Know exactly what to pay, when to pay, and what happens next.

- Understand your payoff order, cost, and timeline

- See which debt to pay off first, and when each will be gone

- Track how payments roll over into the next debt

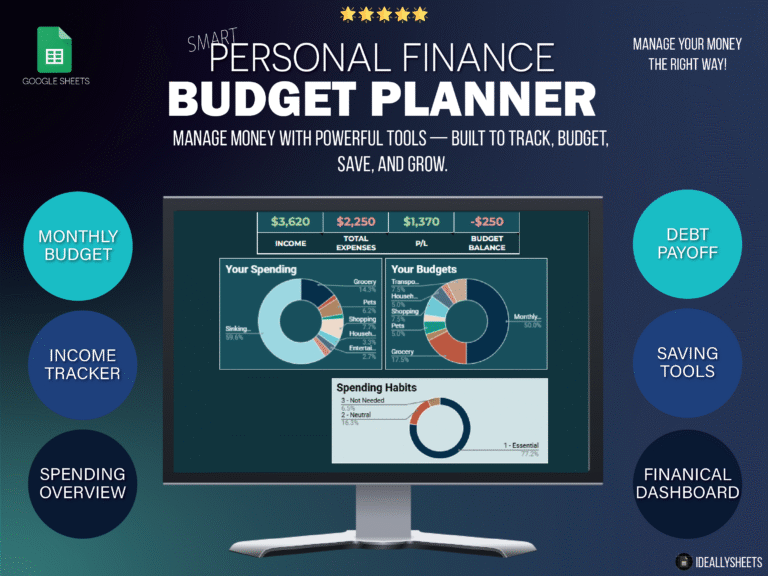

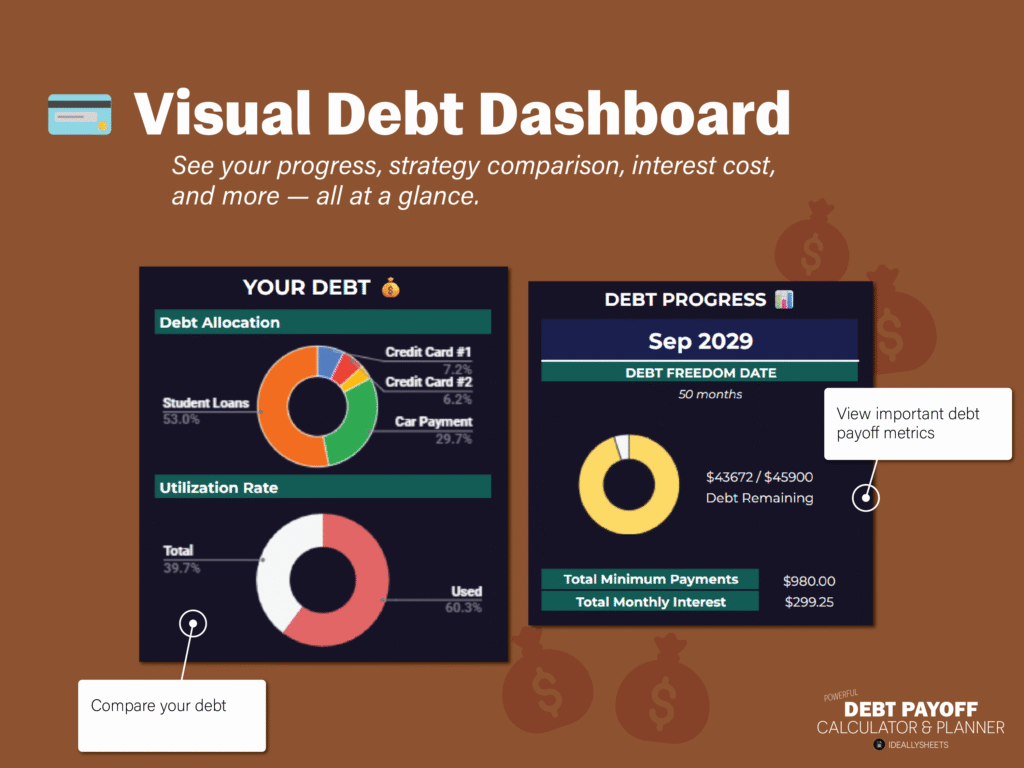

All-in-One Visual Debt Planner Dashboard

Everything you need to stay focused, all in one place.

- Automatically calculates time to payoff and total interest

- Debt payoff progress rings, allocation pie charts, and balance summaries

- See your progress, strategy comparison, interest cost, and more — all at a glance

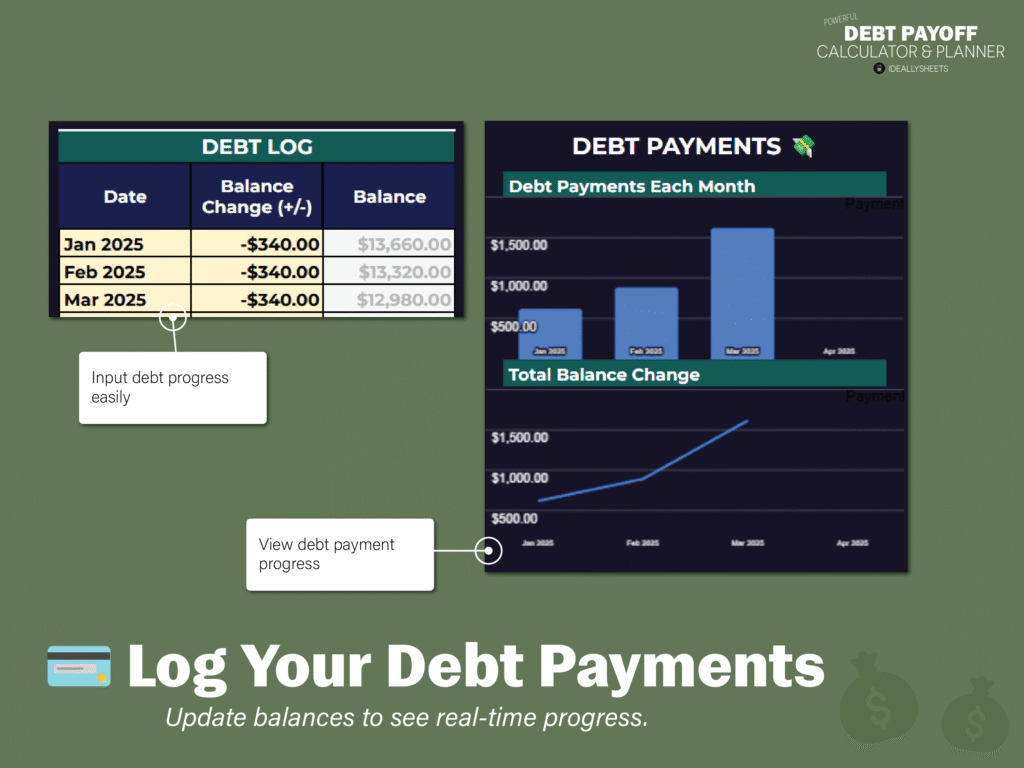

Log Your Debt Payoff and Track Progress

Stay motivated with smart, dynamic tracking tools.

- See your progress visually with charts and color-coded insights

- Update balances to see real-time progress

- Log monthly payments to see balance changes

The strategies implemented assume you don’t reduce your minimum monthly payments and roll over any extra payments into the next debt. A key to paying down debt fast.

Check out the newest release | Update Log

v1 (08/04/2025) – first version released