Easiest way to calculate and track your net worth over time!

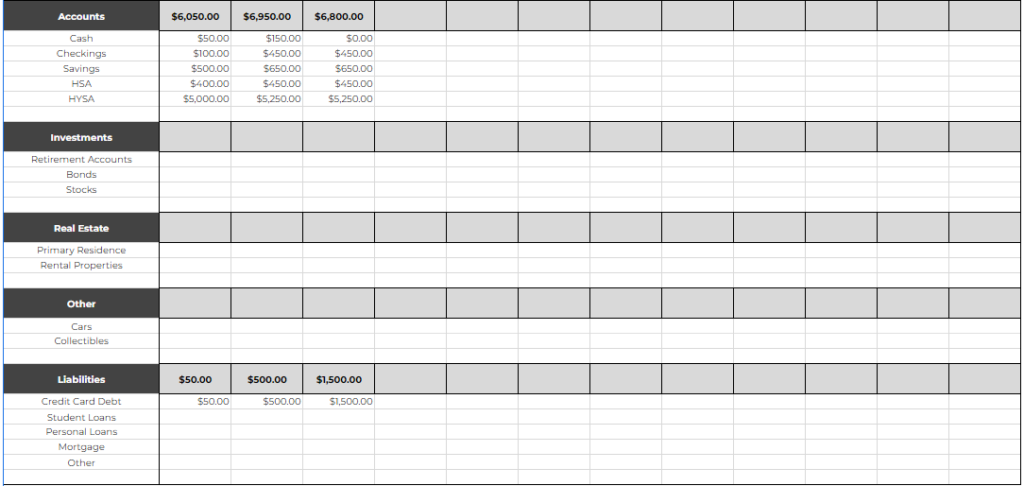

This comprehensive Net Worth Spreadsheet is designed to provide an insightful and detailed overview of your financial health. Tailored for customization, it offers an intuitive layout to meticulously track and analyze your financial assets and liabilities over time.

What is Net Worth?

Net worth is one number that represents your overall financial health. To keep it simple it’s assets – liabilities.

Assets are anything you own, a car, electronics, investments, or cash, whereas liabilities are anything you owe, which can also be a car *if you owe, but are mainly your unpaid debt balance. Net worth is not just a cool number to see how much your favorite actor is worth, it’s an important measure and helpful indicator of financial health and stability. CNBC has a great in-depth article about net worth, you can give it a quick read here.

Instructions for your Net Worth Spreadsheet

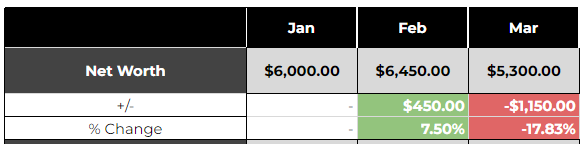

There are 5 main categories, and then the sub-categories are under those. The first row in the table represents your net worth, where +/- and % under. I condensed these categories, however, look at this Net Worth calculator by the FDIC to get a better idea of additional categories you can add. To add a subcategory, right-click the last row in that category (the blank), and insert 1 row above. To delete, right-click the last row in that category, and delete row. These subcategories will be under the main categories, which are either Accounts, Investments, Real Estate, Other, and Liabilities.

In the net worth spreadsheet, start by listing off your assets, and you’ll see a cumulative number in each category row. The first asset category is Accounts, then head down the list into Investments, Real Estate, etc.

Once you finish all your assets it’s now time to move on to liabilities, which is the last category. Here you’ll list any debts. Mortgages, loans, etc.

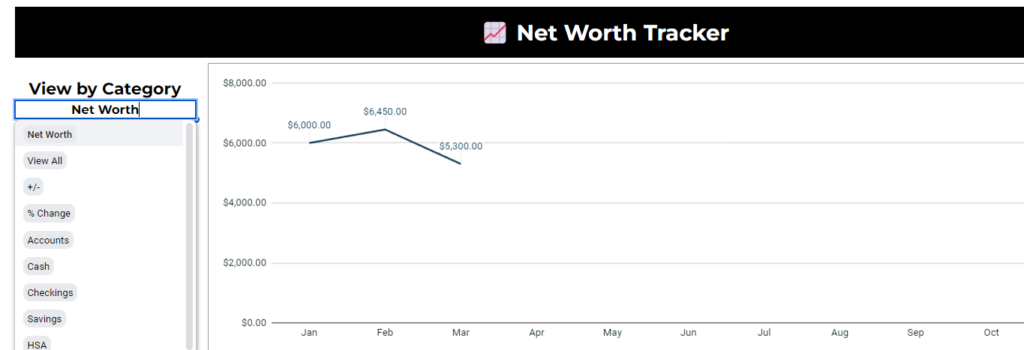

Now you’re finished! Enjoy meaningful insights into your financial picture. Feel free to use the chart to your advantage, with category filtering enabled for insightful visualizations.

Remember, the first row in the chart will display your net worth, and over time the +/- and % change will be filled out.

Check out the newest release | Update Log

v1 (3/19/24) – first version released