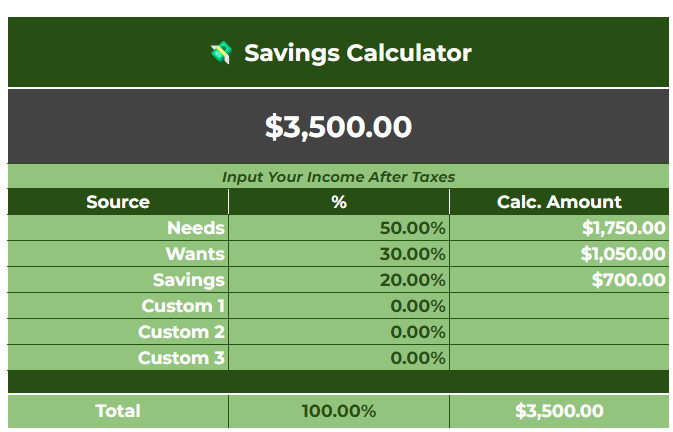

Be Smarter with This 50/30/20 Rule Spreadsheet!

Plan for your future by using the 50/30/20 rule spreadsheet strategy. This spreadsheet keeps it simple. Input your income, and get calculated amounts on how to budget accordingly. Track your strategy and allocation over time with a dynamic chart.

What is the 50/30/20 Rule?

The 50-30-20 rule states putting 50% of your money toward needs (bills, rent, groceries), 30% toward wants (eating out, vacations, most subscriptions), and 20% toward savings (investments, emergency funds). In other words,

- Needs are “I can’t live without”

- Wants are “this makes my life better”

- Savings are “future expenses”

The 50/30/20 rule makes budgeting easy and simple! Here’s a short article by the United Nations Federal Credit Union. This article by Investopedia is also a great read that is more detailed with examples. Here’s a 50/30/20 rule calculator by Nerd Wallet, but you have to sign up for an account. The 50/30/20 rule spreadsheet aligns with the philosophy of the 50/30/20 rule!

Instructions for Your 50/30/20 Rule Spreadsheet

Start by inputting your income, ideally after tax.

View the calculated numbers, and adjust percentages if needed. Custom categories allow for more custom applications.

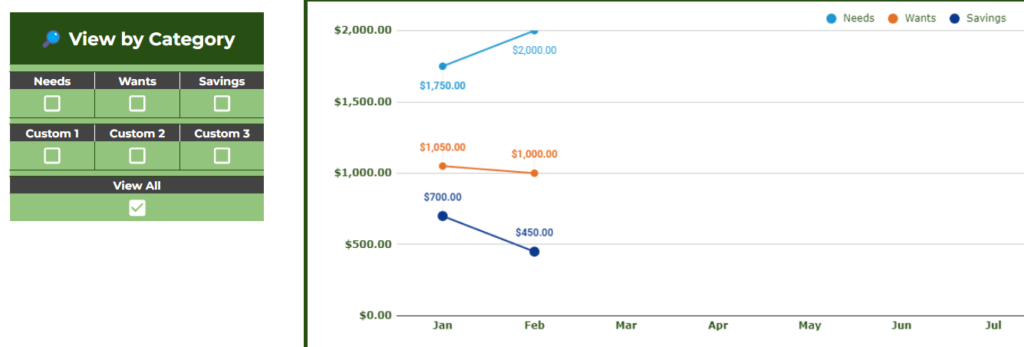

Track your allocation over time with this table. Simply put the dedicated amount each money from each category.

Lastly, enjoy the visual chart where you can view by category.

Check out the newest release | Update Log

v1 (3/19/24) – first version released