It’s Time to Take Control of Your Debt

Take control of your debt with this debt payoff calculator that assists in visualizing and strategizing your way to debt freedom! This powerful tool is designed to help eliminate debt smarter and faster. This template allows you to explore different debt payment strategies while seeing all the numbers behind it, such as interest and months to pay off a debt. You’ll become much more knowledgeable about your debt! Enjoy this Google Sheets debt payoff template for free.

There are many versions of debt payoff calculators out there, such as Credit Karma’s debt payoff calculator. However, most of them lack the customization needed to get a better visualization of your debt. This is where spreadsheets come in handy. This template utilizes the snowball and avalanche strategies as the main ways to pay off debt. You’ll be shocked at how good these strategies are!

Interested in contributing? Donations can be made through my website. A lot of time goes into these templates, and I want to keep them free. For this template, don’t donate until you pay that debt off! You can also show support by following me on my socials @ideallysheets, where I post new templates and tips frequently.

Anyways, good luck you got this! Don’t get discouraged as you’re taking action towards your debt, and nowadays it’s so easy to accumulate debt.

Instructions for Your Debt Payoff Calculator

Make sure to click the link above and click the “Use Template” button at the top right. I also highly recommend watching this YouTube video I made to fully leverage this spreadsheet.

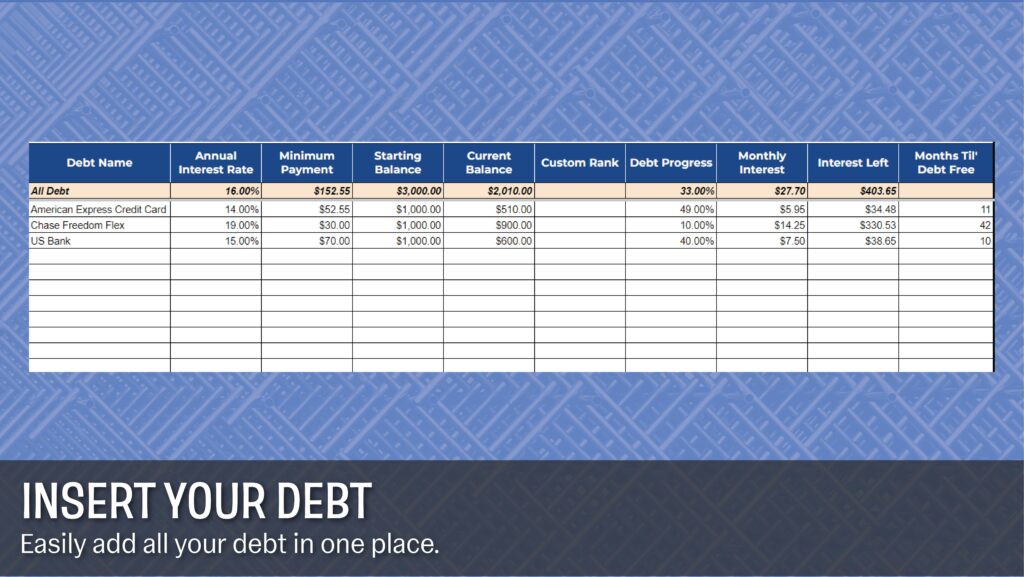

Insert Your Debt

Inserting your debt should be simple, you only need to fill in columns A-F, and the rest will automatically get filled in.

- Annual Interest Rate – for most you can find this % online, it’s super important you know this for your own sake

- Minimum Payment – most debt has a minimum payment you have to pay each month, find that payment and put it in, as you pay things off your minimum payment will reduce, it is up to you if you want to adjust your minimum payment each month, your calculation may slightly change. More on this later

- Starting Balance – the total amount you owe

- Current Balance – the total amount you owe, but as you pay things off you can adjust this field

- Custom Rank – your own ranking to pay off your debt, I’ll talk about this more in a second

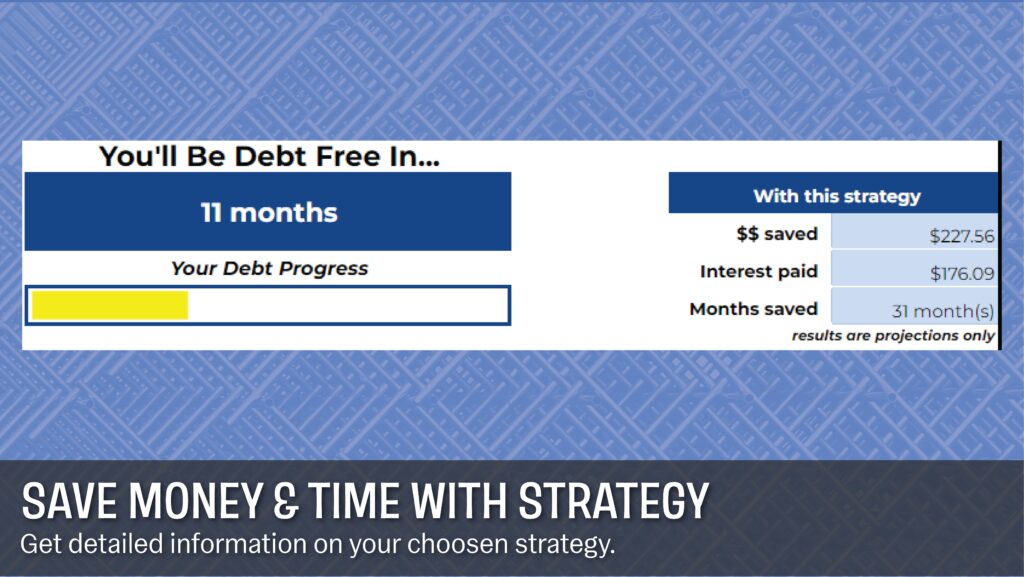

Debt Calculator

Here’s where the magic happens. Once you insert your debt, under ‘Choose your strategy’, you’ll have the option to put how much additional monthly money you can put towards debt each month, this does NOT include minimum payments. Here’s a description of the debt payment strategies:

- Snowball – start with the smallest debts first

- Avalanche – target high-interest debts first

- Custom Rank – follow your personalized debt repayment plan (column F)

- None – no rolling minimum payments or overpayments (more on this later)

FYI, for some visualization, it’s called ‘Snowball’ because all your payments accumulate into the next debt. All of these strategies assume once a debt is paid off, you’re putting that minimum payment towards the next debt.

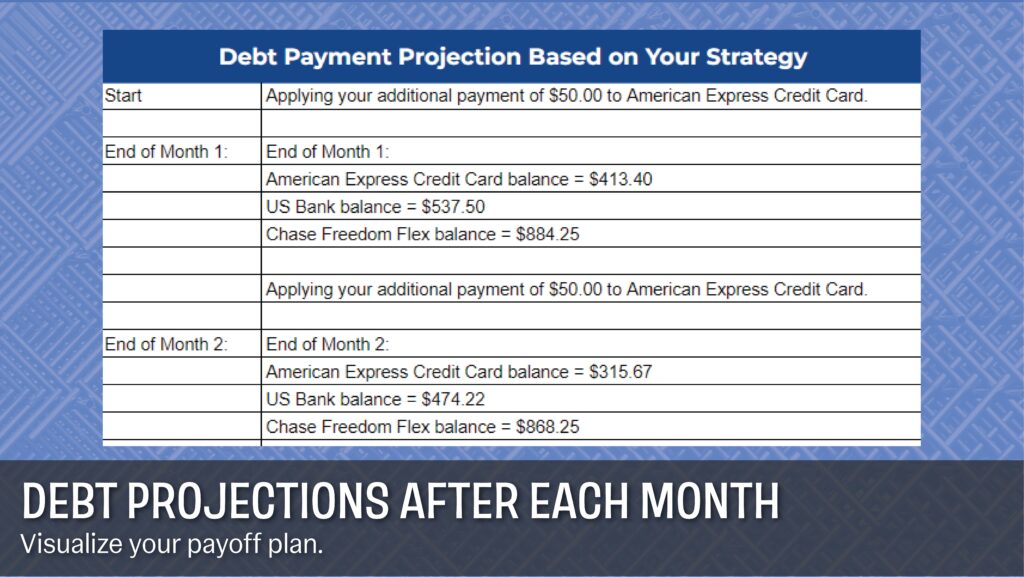

Debt Payment Projection Tab

Visualize your debt here and view what debts to pay off first based on your strategy. You’ll also see your projected balance at the end of each month. Here’s some terminology you need:

- Rolling minimum payments – once a debt is paid off, that minimum payment will be applied to the next priority debt

- Overpayment – allocated funds towards a debt might exceed the debt balance on the month it gets paid off, so an overpayment is then applied to the next debt

- Additional payment – the additional amount of money you devote to paying off your debt each money

I hope you gain insight into how important it is to do more than the minimum, and once you pay it off, take that minimum payment and transfer it to the next debt.

Quick Note About Minimum Payments

As you pay off your debt, in many cases that minimum payment is reduced. The calculations in this template are based on a static minimum payment that doesn’t change, so technically you could pay off things slightly faster if you follow the strategy you choose and adjust your minimum payments accordingly. Again this template doesn’t adjust the minimum payment automatically, and it might be tedious for you to update them every month, but you can!

Good luck! I hope this offers some direction and motivation! You aren’t alone! It’s so easy to get into debt but you’re making the right steps. Feel free to send me any questions or suggestions.

Check out the newest release | Update Log

v1 – first version, released 1/30/2024