Ditch the Apps: Why Budgeting in a Spreadsheet Just Works

Want to get serious about your finances without downloading yet another budgeting app? A spreadsheet might be your secret weapon. In this guide, you’ll learn what makes a powerful personal budget spreadsheet that works in any situation. Not only that, you’ll learn strategies proven for a successful budget. Whether you’re just starting or looking to level up your system, this guide will walk you through every step, with tips, mindset shifts, and helpful tools.

📥 [Download our free budgeting spreadsheet to follow along]

Why Use a Spreadsheet?

- Banks and apps can track your spending for you, but a spreadsheet allows you to track spending with intention.

- You’re more mindful when you enter your expenses.

- You can customize everything: categories, formulas, and visualizations.

Why Budget?

- Budgeting helps you plan, reduce stress, and feel in control.

- It’s not about restriction — it’s about intention(!)

- A budget is needed to plan for the future.

How to Set Up Your Budget Using Spreadsheets (Step-by-Step)

1. Choose a Template (or Make Your Own)

- Free options in Google Sheets

- Free options in Excel

- Paid templates on Etsy

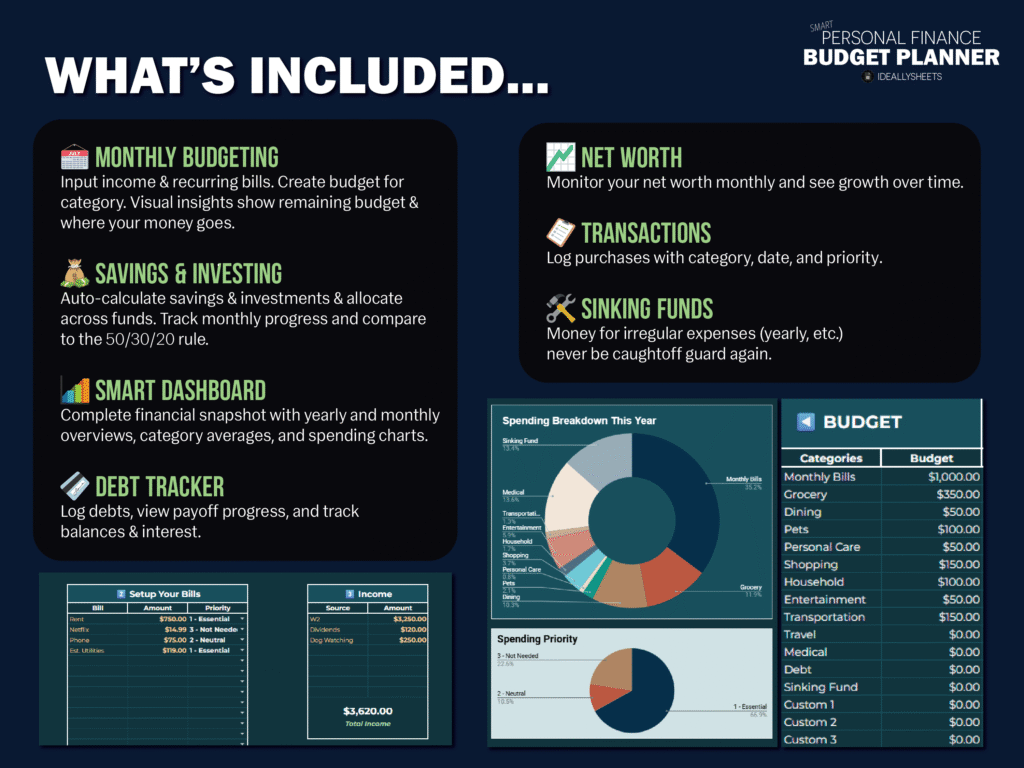

- Our templates include:

- Free Simple Starter Budget – Just the basics

- Free Advanced Budget – Some advanced features

- Pro Version – With dashboards, sinking funds, debt payoff, 50/30/20 tracking, and more

📥 Here’s what’s included in our Pro version → Get Here

All in all, a good template has the necessities and can be customized.

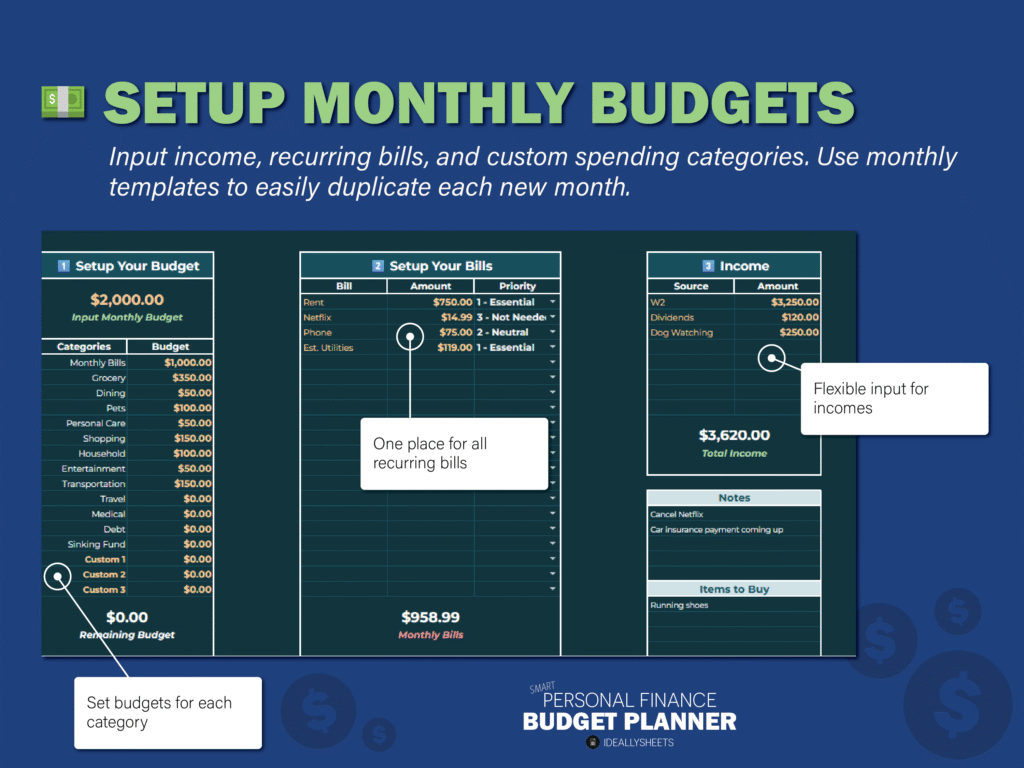

2. Calculate Your Income

- Estimate your monthly income — whether it’s fixed or variable.

- Be conservative (it’s always better to budget a little lower than you make)

Variable income?

It’s absolutely possible to budget with a freelancing job, commission-based work, or any income that fluctuates month to month. One of the most effective strategies we’ve seen is to avoid budgeting based on your full income.

Instead, choose a conservative monthly amount — one you’re confident you can meet consistently — and build your budget around that number. Think of it like running a business: pay yourself a fixed “salary” by transferring that amount from your business or income account to your personal spending account each month.

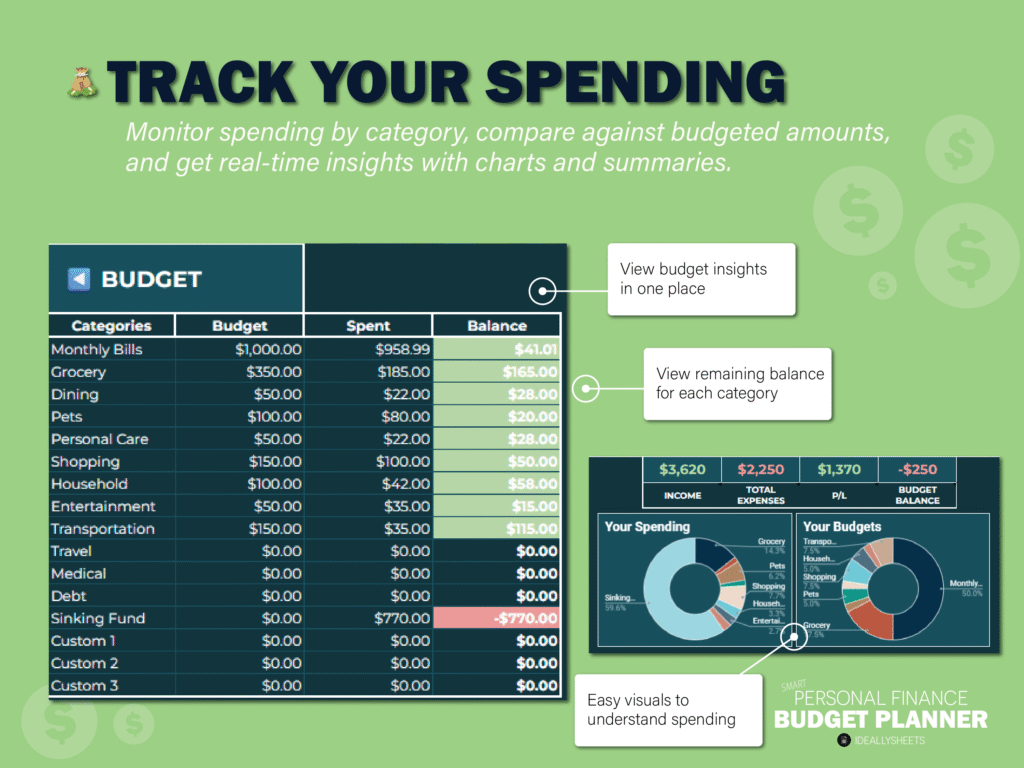

3. Categorize Expenses & Set Budgets in Your Budget Spreadsheet

- Figure out what expense categories make sense for you.

- For example, our spreadsheet uses these categories:

- Monthly Bills

- Grocery

- Dining

- Pets

- Personal Care

- Shopping

- Household

- Entertainment

- Transportation

- Travel

- Medical

- Debt

- Sinking Fund

- For example, our spreadsheet uses these categories:

Set your budget amounts. Make sure to include both fixed costs (like rent or phone bills) and variable expenses (like groceries or gas). If you’re not sure what to budget for each category, look at your past 1–2 months of spending as a guide. If this is your first time budgeting. Start with estimates, then adjust over time. Use a sinking fund for those sneaky expenses like annual bills.

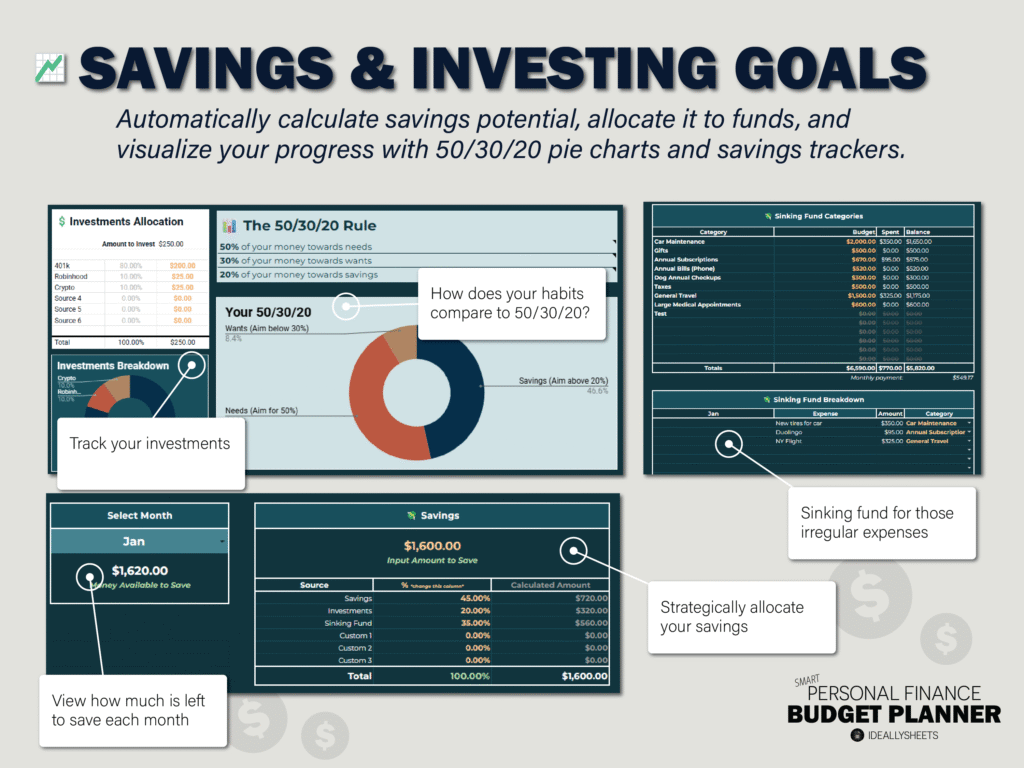

Sinking Fund Explained

It always feels like the moment we start getting our finances in order, a surprise bill shows up out of nowhere. Maybe it’s an annual subscription, a car repair, or a medical expense. But let’s be honest — these costs aren’t really surprises. We just don’t like thinking about them until they hit. That’s exactly where a sinking fund comes in.

A sinking fund helps you plan for those “unexpected” but actually expected expenses by saving for them gradually. Think car maintenance, yearly memberships, holiday spending — anything that isn’t monthly but always shows up. The difference between a sinking fund and an emergency fund is that an emergency fund is used for emergencies only, like job loss, loss of housing, etc.

Here’s how to set up your sinking fund:

- List those non-monthly expenses, for example:

- Annual subscriptions (Credit card annual expenses, Costco, etc.)

- Car maintenance

- Gifts

- Travel

- Big pet bills

- Medical

- House repairs

- Add them up → divide by 12 → save monthly (ideally in a separate account)

- Our Pro Spreadsheet includes a built-in sinking fund tracker

4. Input Expenses & Set a Routine to Update Budget

- Decide: Weekly review? Daily input? Monthly check-in?

- Our template is designed for once-a-week check-ins (10 min tops)

We don’t want this spreadsheet to consume your life, and we’re not aiming for perfection. Budgeting with a spreadsheet already gives you a huge advantage over apps: you can actually categorize your spending correctly. Don’t stress about tracking every single penny. Most people miss a few small expenses each month, and that’s okay. Expert budgets may try to plan every dollar, but in real life, that’s rarely sustainable. Consistency beats perfection every time!

What has worked best? A weekly review. Take 10–15 minutes once a week to check in, input transactions, update any, and reflect to see how you’re doing.

💡Pro tip: Use your phone’s notes app to jot down anything you pay for in cash or on Venmo — especially since no one uses the memo field properly anyway!

5. Use Formulas to Your Advantage

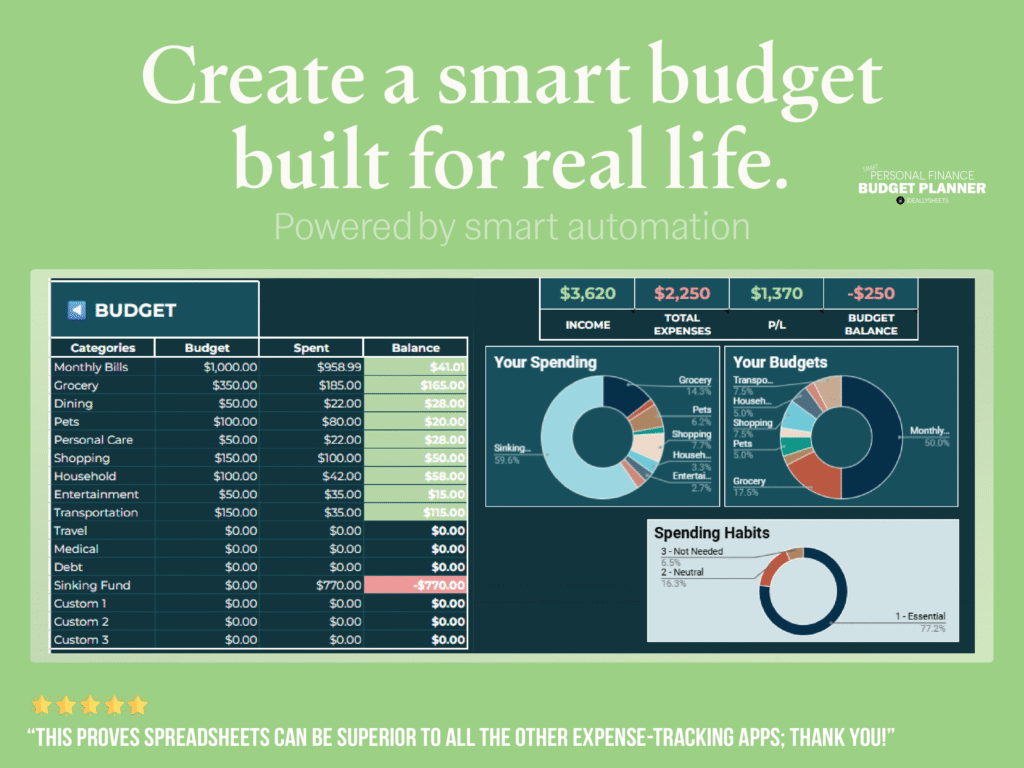

What’s the best way to see how you’re doing? One of the biggest benefits of using a spreadsheet is the ability to automate calculations and gain real insight into your spending, without doing the math yourself. Even basic functions can help you quickly spot trends or see when you’re going over budget.

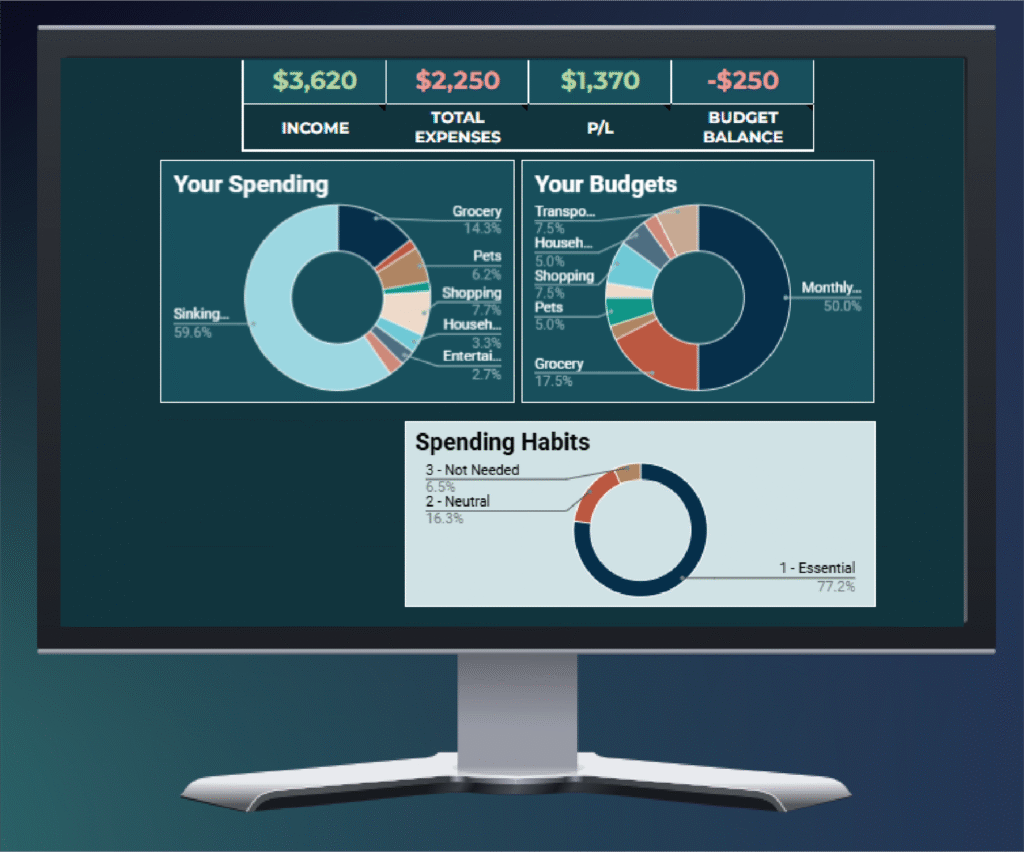

In our own setup, we use formulas like:

AVERAGEto track your typical spending in each categorySUMIFSto calculate totals by month or categoryVLOOKUPto pull in data across different sheets- Conditional formatting to make positive numbers green and negative numbers red

- and custom dashboards that summarize your income, spending, and savings over time

You don’t need to be a spreadsheet pro — just knowing these tools exist (and using a good template) can make budgeting feel smarter, faster, and way less intimidating.

6. General Tips for Budgeting with Spreadsheets

Don’t Budget Too Tightly

- Leave room for life: takeout, fun, “oops” spending.

- A strict budget backfires: studies show people overspend without flexibility.

Try the 50/30/20 Rule

- 50% Needs | 30% Wants | 20% Savings/Debt

- For example, our template visualizes this with a monthly pie chart auto-generated from your data.

Conclusion: Budgeting Doesn’t Have to Be Complicated with Spreadsheets

Whether new to budgeting or looking to refine your system, a spreadsheet gives you clarity, control, and customization.

Take budgeting further with our Pro version, which includes:

- Smart dashboards

- Spending habit breakdowns

- Debt & savings tools

- Net worth & investment tracking